자유게시판

오늘의 시장참여자들의 주요 옵션 거래

September 7, 2021 01:53 PM ET (BZ Newswire) — Options

This unusual options alert can help traders track potentially big

trading opportunities. Traders often look for circumstances when the

market estimation of an option diverges away from its normal worth.

Unusual trading activity could push option prices to hyperbolic or

underperforming levels.

Here’s the list of some unusual options activity happening in today’s

session:

|

|

Symbol |

|

PUT/CALL |

|

Trade Type |

|

Sentiment |

|

Exp. Date |

|

Strike Price |

|

Total Trade Price |

|

Open Interest |

|

Volume |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

TSLA |

|

CALL |

|

SWEEP |

|

BEARISH |

|

09/10/21 |

|

$750.00 |

|

$195.9K |

|

13.2K |

|

53.4K |

|

|

|

DKNG |

|

CALL |

|

TRADE |

|

BULLISH |

|

09/10/21 |

|

$62.50 |

|

$32.0K |

|

1.9K |

|

10.5K |

|

|

|

BABA |

|

CALL |

|

SWEEP |

|

BULLISH |

|

09/17/21 |

|

$180.00 |

|

$182.9K |

|

11.9K |

|

7.2K |

|

|

|

CPNG |

|

CALL |

|

SWEEP |

|

BEARISH |

|

09/17/21 |

|

$35.00 |

|

$117.7K |

|

5.6K |

|

6.3K |

|

|

|

ABNB |

|

CALL |

|

SWEEP |

|

BULLISH |

|

09/10/21 |

|

$165.00 |

|

$68.4K |

|

1.9K |

|

5.9K |

|

|

|

NCLH |

|

CALL |

|

TRADE |

|

NEUTRAL |

|

01/20/23 |

|

$30.00 |

|

$210.0K |

|

14.9K |

|

4.1K |

|

|

|

GPS |

|

PUT |

|

SWEEP |

|

BEARISH |

|

09/10/21 |

|

$25.50 |

|

$177.3K |

|

5.3K |

|

3.8K |

|

|

|

BBIG |

|

CALL |

|

SWEEP |

|

BULLISH |

|

01/21/22 |

|

$10.00 |

|

$72.7K |

|

26.6K |

|

2.1K |

|

|

|

BBWI |

|

CALL |

|

TRADE |

|

BULLISH |

|

11/19/21 |

|

$70.00 |

|

$146.0K |

|

18.9K |

|

1.6K |

|

|

|

AMZN |

|

PUT |

|

SWEEP |

|

BEARISH |

|

09/10/21 |

|

$3490.00 |

|

$309.1K |

|

310 |

|

1.4K |

|

Explanation

These itemized elaborations have been created using the accompanying

table.

• Regarding TSLA (NASDAQ:TSLA),

we observe a call option sweep with bearish

sentiment. It expires in 3 day(s) on September 10, 2021.

Parties traded 203 contract(s) at a $750.00

strike. This particular call needed to be split into 26 different trades

to become filled. The total cost received by the writing party (or

parties) was $195.9K, with a price of $960.0

per contract. There were 13281 open contracts at this

strike prior to today, and today 53428 contract(s) were

bought and sold.

• For DKNG (NASDAQ:DKNG),

we notice a call option trade that

happens to be bullish, expiring in 3 day(s) on September

10, 2021. This event was a transfer of 200

contract(s) at a $62.50 strike. The total cost received

by the writing party (or parties) was $32.0K, with a

price of $160.0 per contract. There were 1940

open contracts at this strike prior to today, and today 10518

contract(s) were bought and sold.

• Regarding BABA (NYSE:BABA),

we observe a call option sweep with bullish

sentiment. It expires in 10 day(s) on September 17, 2021.

Parties traded 824 contract(s) at a $180.00

strike. This particular call needed to be split into 34 different trades

to become filled. The total cost received by the writing party (or

parties) was $182.9K, with a price of $222.0

per contract. There were 11991 open contracts at this

strike prior to today, and today 7233 contract(s) were

bought and sold.

• For CPNG (NYSE:CPNG),

we notice a call option sweep that

happens to be bearish, expiring in 10 day(s) on September

17, 2021. This event was a transfer of 3354

contract(s) at a $35.00 strike. This particular call

needed to be split into 40 different trades to become filled. The total

cost received by the writing party (or parties) was $117.7K,

with a price of $35.0 per contract. There were 5680

open contracts at this strike prior to today, and today 6330

contract(s) were bought and sold.

• For ABNB (NASDAQ:ABNB),

we notice a call option sweep that

happens to be bullish, expiring in 3 day(s) on September

10, 2021. This event was a transfer of 391

contract(s) at a $165.00 strike. This particular call

needed to be split into 38 different trades to become filled. The total

cost received by the writing party (or parties) was $68.4K,

with a price of $175.0 per contract. There were 1969

open contracts at this strike prior to today, and today 5974

contract(s) were bought and sold.

• Regarding NCLH (NYSE:NCLH),

we observe a call option trade with neutral

sentiment. It expires in 500 day(s) on January 20, 2023.

Parties traded 500 contract(s) at a $30.00

strike. The total cost received by the writing party (or parties) was $210.0K,

with a price of $420.0 per contract. There were 14996

open contracts at this strike prior to today, and today 4141

contract(s) were bought and sold.

• For GPS (NYSE:GPS),

we notice a put option sweep that

happens to be bearish, expiring in 3 day(s) on September

10, 2021. This event was a transfer of 1840

contract(s) at a $25.50 strike. This particular put

needed to be split into 64 different trades to become filled. The total

cost received by the writing party (or parties) was $177.3K,

with a price of $99.0 per contract. There were 5365

open contracts at this strike prior to today, and today 3855

contract(s) were bought and sold.

• Regarding BBIG (NASDAQ:BBIG),

we observe a call option sweep with bullish

sentiment. It expires in 136 day(s) on January 21, 2022.

Parties traded 291 contract(s) at a $10.00

strike. This particular call needed to be split into 7 different trades

to become filled. The total cost received by the writing party (or

parties) was $72.7K, with a price of $250.0

per contract. There were 26651 open contracts at this

strike prior to today, and today 2143 contract(s) were

bought and sold.

• Regarding BBWI (NYSE:BBWI),

we observe a call option trade with bullish

sentiment. It expires in 73 day(s) on November 19, 2021.

Parties traded 400 contract(s) at a $70.00

strike. The total cost received by the writing party (or parties) was $146.0K,

with a price of $365.0 per contract. There were 18900

open contracts at this strike prior to today, and today 1614

contract(s) were bought and sold.

• Regarding AMZN (NASDAQ:AMZN),

we observe a put option sweep with bearish

sentiment. It expires in 3 day(s) on September 10, 2021.

Parties traded 215 contract(s) at a $3490.00

strike. This particular put needed to be split into 47 different trades

to become filled. The total cost received by the writing party (or

parties) was $309.1K, with a price of $1455.0

per contract. There were 310 open contracts at this

strike prior to today, and today 1472 contract(s) were

bought and sold.

| 번호 | 제목 | 작성자 | 작성일 | 추천 | 조회 |

| 공지사항 |

미국옵션 GPT (미옵 GPT) 를 런칭합니다! (12)

LowKey

|

2024.01.11

|

추천 3

|

조회 4642

|

LowKey | 2024.01.11 | 3 | 4642 |

| 공지사항 |

[공지] 미옵 ETF 옵션 데일리 요약/분석 관련 (26)

LowKey

|

2022.05.31

|

추천 8

|

조회 7495

|

LowKey | 2022.05.31 | 8 | 7495 |

| 공지사항 |

[공지] 개인블로그 및 기타 광고 관련 미국옵션 공유 방침

LowKey

|

2021.10.19

|

추천 3

|

조회 7259

|

LowKey | 2021.10.19 | 3 | 7259 |

| 공지사항 |

[공지] 채팅창에서 다른분들과 같이 의견을 교류할때의 템플릿 (11)

LowKey

|

2021.08.09

|

추천 5

|

조회 7825

|

LowKey | 2021.08.09 | 5 | 7825 |

| 공지사항 |

[인사말] 미국옵션에 오신걸 환영합니다. (28)

LowKey

|

2021.07.17

|

추천 5

|

조회 6799

|

LowKey | 2021.07.17 | 5 | 6799 |

| 858 |

한국에서 미국 주식 옵션 거래하는 채널이… (1)

니크네이임

|

2025.06.25

|

추천 3

|

조회 175

|

니크네이임 | 2025.06.25 | 3 | 175 |

| 857 |

미국 옵션 공부해보려 합니다. (2)

박태영 (스튜디오에 사는 개들)

|

2025.06.05

|

추천 0

|

조회 427

|

박태영 (스튜디오에 사는 개들) | 2025.06.05 | 0 | 427 |

| 856 |

옵션 스캘핑의 유혹 (1)

hongbro

|

2025.05.27

|

추천 1

|

조회 494

|

hongbro | 2025.05.27 | 1 | 494 |

| 855 |

안녕하세요 (3)

밍하이

|

2025.05.22

|

추천 0

|

조회 540

|

밍하이 | 2025.05.22 | 0 | 540 |

| 854 |

가입인사드립니다. (2)

비트 500k

|

2025.05.21

|

추천 0

|

조회 540

|

비트 500k | 2025.05.21 | 0 | 540 |

| 853 |

CHAT GPT(Mikook Option)에서 전략 세우기 (2)

Miso

|

2025.04.25

|

추천 1

|

조회 702

|

Miso | 2025.04.25 | 1 | 702 |

| 852 |

미국 옵션에 대하여 공부하기가 쉽지는 않았습니다. (4)

Miso

|

2025.04.16

|

추천 0

|

조회 869

|

Miso | 2025.04.16 | 0 | 869 |

| 851 |

미주 헷징 (3)

호랑이

|

2025.04.04

|

추천 0

|

조회 607

|

호랑이 | 2025.04.04 | 0 | 607 |

| 850 |

미국 주식 콜옵션, 왜 어떤 사람들은 만기 전에 행사할까? (4)

LowKey

|

2025.03.27

|

추천 2

|

조회 716

|

LowKey | 2025.03.27 | 2 | 716 |

| 849 |

미국 경제지표는 아직 좋다하는데…지금의 하락이 단순한 조정인건지..아님 리세션 초입인건지..너무 힘드네요.. (2)

ans

|

2025.03.23

|

추천 1

|

조회 492

|

ans | 2025.03.23 | 1 | 492 |

자유게시판

오늘의 시장참여자들의 주요 옵션 거래

September 7, 2021 01:53 PM ET (BZ Newswire) — Options

This unusual options alert can help traders track potentially big

trading opportunities. Traders often look for circumstances when the

market estimation of an option diverges away from its normal worth.

Unusual trading activity could push option prices to hyperbolic or

underperforming levels.

Here’s the list of some unusual options activity happening in today’s

session:

|

|

Symbol |

|

PUT/CALL |

|

Trade Type |

|

Sentiment |

|

Exp. Date |

|

Strike Price |

|

Total Trade Price |

|

Open Interest |

|

Volume |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

TSLA |

|

CALL |

|

SWEEP |

|

BEARISH |

|

09/10/21 |

|

$750.00 |

|

$195.9K |

|

13.2K |

|

53.4K |

|

|

|

DKNG |

|

CALL |

|

TRADE |

|

BULLISH |

|

09/10/21 |

|

$62.50 |

|

$32.0K |

|

1.9K |

|

10.5K |

|

|

|

BABA |

|

CALL |

|

SWEEP |

|

BULLISH |

|

09/17/21 |

|

$180.00 |

|

$182.9K |

|

11.9K |

|

7.2K |

|

|

|

CPNG |

|

CALL |

|

SWEEP |

|

BEARISH |

|

09/17/21 |

|

$35.00 |

|

$117.7K |

|

5.6K |

|

6.3K |

|

|

|

ABNB |

|

CALL |

|

SWEEP |

|

BULLISH |

|

09/10/21 |

|

$165.00 |

|

$68.4K |

|

1.9K |

|

5.9K |

|

|

|

NCLH |

|

CALL |

|

TRADE |

|

NEUTRAL |

|

01/20/23 |

|

$30.00 |

|

$210.0K |

|

14.9K |

|

4.1K |

|

|

|

GPS |

|

PUT |

|

SWEEP |

|

BEARISH |

|

09/10/21 |

|

$25.50 |

|

$177.3K |

|

5.3K |

|

3.8K |

|

|

|

BBIG |

|

CALL |

|

SWEEP |

|

BULLISH |

|

01/21/22 |

|

$10.00 |

|

$72.7K |

|

26.6K |

|

2.1K |

|

|

|

BBWI |

|

CALL |

|

TRADE |

|

BULLISH |

|

11/19/21 |

|

$70.00 |

|

$146.0K |

|

18.9K |

|

1.6K |

|

|

|

AMZN |

|

PUT |

|

SWEEP |

|

BEARISH |

|

09/10/21 |

|

$3490.00 |

|

$309.1K |

|

310 |

|

1.4K |

|

Explanation

These itemized elaborations have been created using the accompanying

table.

• Regarding TSLA (NASDAQ:TSLA),

we observe a call option sweep with bearish

sentiment. It expires in 3 day(s) on September 10, 2021.

Parties traded 203 contract(s) at a $750.00

strike. This particular call needed to be split into 26 different trades

to become filled. The total cost received by the writing party (or

parties) was $195.9K, with a price of $960.0

per contract. There were 13281 open contracts at this

strike prior to today, and today 53428 contract(s) were

bought and sold.

• For DKNG (NASDAQ:DKNG),

we notice a call option trade that

happens to be bullish, expiring in 3 day(s) on September

10, 2021. This event was a transfer of 200

contract(s) at a $62.50 strike. The total cost received

by the writing party (or parties) was $32.0K, with a

price of $160.0 per contract. There were 1940

open contracts at this strike prior to today, and today 10518

contract(s) were bought and sold.

• Regarding BABA (NYSE:BABA),

we observe a call option sweep with bullish

sentiment. It expires in 10 day(s) on September 17, 2021.

Parties traded 824 contract(s) at a $180.00

strike. This particular call needed to be split into 34 different trades

to become filled. The total cost received by the writing party (or

parties) was $182.9K, with a price of $222.0

per contract. There were 11991 open contracts at this

strike prior to today, and today 7233 contract(s) were

bought and sold.

• For CPNG (NYSE:CPNG),

we notice a call option sweep that

happens to be bearish, expiring in 10 day(s) on September

17, 2021. This event was a transfer of 3354

contract(s) at a $35.00 strike. This particular call

needed to be split into 40 different trades to become filled. The total

cost received by the writing party (or parties) was $117.7K,

with a price of $35.0 per contract. There were 5680

open contracts at this strike prior to today, and today 6330

contract(s) were bought and sold.

• For ABNB (NASDAQ:ABNB),

we notice a call option sweep that

happens to be bullish, expiring in 3 day(s) on September

10, 2021. This event was a transfer of 391

contract(s) at a $165.00 strike. This particular call

needed to be split into 38 different trades to become filled. The total

cost received by the writing party (or parties) was $68.4K,

with a price of $175.0 per contract. There were 1969

open contracts at this strike prior to today, and today 5974

contract(s) were bought and sold.

• Regarding NCLH (NYSE:NCLH),

we observe a call option trade with neutral

sentiment. It expires in 500 day(s) on January 20, 2023.

Parties traded 500 contract(s) at a $30.00

strike. The total cost received by the writing party (or parties) was $210.0K,

with a price of $420.0 per contract. There were 14996

open contracts at this strike prior to today, and today 4141

contract(s) were bought and sold.

• For GPS (NYSE:GPS),

we notice a put option sweep that

happens to be bearish, expiring in 3 day(s) on September

10, 2021. This event was a transfer of 1840

contract(s) at a $25.50 strike. This particular put

needed to be split into 64 different trades to become filled. The total

cost received by the writing party (or parties) was $177.3K,

with a price of $99.0 per contract. There were 5365

open contracts at this strike prior to today, and today 3855

contract(s) were bought and sold.

• Regarding BBIG (NASDAQ:BBIG),

we observe a call option sweep with bullish

sentiment. It expires in 136 day(s) on January 21, 2022.

Parties traded 291 contract(s) at a $10.00

strike. This particular call needed to be split into 7 different trades

to become filled. The total cost received by the writing party (or

parties) was $72.7K, with a price of $250.0

per contract. There were 26651 open contracts at this

strike prior to today, and today 2143 contract(s) were

bought and sold.

• Regarding BBWI (NYSE:BBWI),

we observe a call option trade with bullish

sentiment. It expires in 73 day(s) on November 19, 2021.

Parties traded 400 contract(s) at a $70.00

strike. The total cost received by the writing party (or parties) was $146.0K,

with a price of $365.0 per contract. There were 18900

open contracts at this strike prior to today, and today 1614

contract(s) were bought and sold.

• Regarding AMZN (NASDAQ:AMZN),

we observe a put option sweep with bearish

sentiment. It expires in 3 day(s) on September 10, 2021.

Parties traded 215 contract(s) at a $3490.00

strike. This particular put needed to be split into 47 different trades

to become filled. The total cost received by the writing party (or

parties) was $309.1K, with a price of $1455.0

per contract. There were 310 open contracts at this

strike prior to today, and today 1472 contract(s) were

bought and sold.

-

LowKey 2021-09-07 12:25

LowKey 2021-09-07 12:25오늘 쿠팡은 그와중에 상승

-

텍사스

2021-09-07 13:22글게요 쿠팡 엄청 올랐네

-

| 번호 | 제목 | 작성자 | 작성일 | 추천 | 조회 |

| 공지사항 |

미국옵션 GPT (미옵 GPT) 를 런칭합니다! (12)

LowKey

|

2024.01.11

|

추천 3

|

조회 4642

|

LowKey | 2024.01.11 | 3 | 4642 |

| 공지사항 |

[공지] 미옵 ETF 옵션 데일리 요약/분석 관련 (26)

LowKey

|

2022.05.31

|

추천 8

|

조회 7495

|

LowKey | 2022.05.31 | 8 | 7495 |

| 공지사항 |

[공지] 개인블로그 및 기타 광고 관련 미국옵션 공유 방침

LowKey

|

2021.10.19

|

추천 3

|

조회 7259

|

LowKey | 2021.10.19 | 3 | 7259 |

| 공지사항 |

[공지] 채팅창에서 다른분들과 같이 의견을 교류할때의 템플릿 (11)

LowKey

|

2021.08.09

|

추천 5

|

조회 7825

|

LowKey | 2021.08.09 | 5 | 7825 |

| 공지사항 |

[인사말] 미국옵션에 오신걸 환영합니다. (28)

LowKey

|

2021.07.17

|

추천 5

|

조회 6799

|

LowKey | 2021.07.17 | 5 | 6799 |

| 858 |

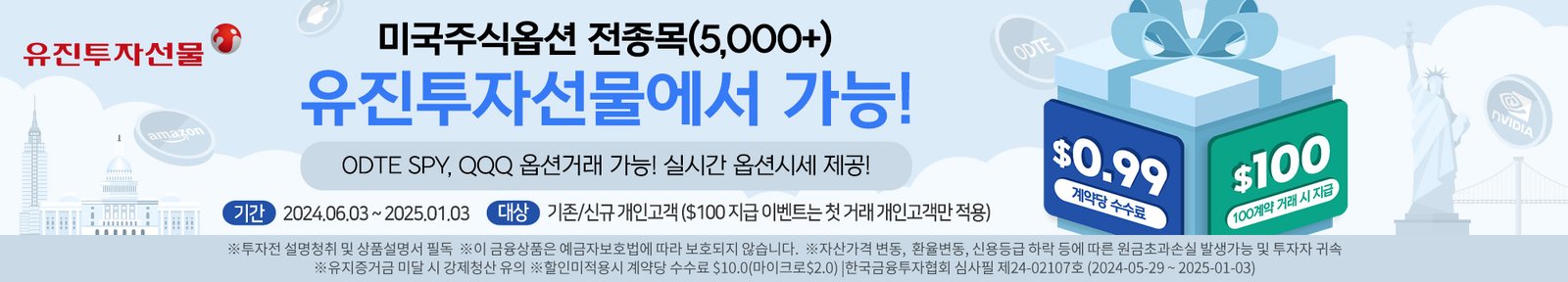

한국에서 미국 주식 옵션 거래하는 채널이… (1)

니크네이임

|

2025.06.25

|

추천 3

|

조회 175

|

니크네이임 | 2025.06.25 | 3 | 175 |

| 857 |

미국 옵션 공부해보려 합니다. (2)

박태영 (스튜디오에 사는 개들)

|

2025.06.05

|

추천 0

|

조회 427

|

박태영 (스튜디오에 사는 개들) | 2025.06.05 | 0 | 427 |

| 856 |

옵션 스캘핑의 유혹 (1)

hongbro

|

2025.05.27

|

추천 1

|

조회 494

|

hongbro | 2025.05.27 | 1 | 494 |

| 855 |

안녕하세요 (3)

밍하이

|

2025.05.22

|

추천 0

|

조회 540

|

밍하이 | 2025.05.22 | 0 | 540 |

| 854 |

가입인사드립니다. (2)

비트 500k

|

2025.05.21

|

추천 0

|

조회 540

|

비트 500k | 2025.05.21 | 0 | 540 |

| 853 |

CHAT GPT(Mikook Option)에서 전략 세우기 (2)

Miso

|

2025.04.25

|

추천 1

|

조회 702

|

Miso | 2025.04.25 | 1 | 702 |

| 852 |

미국 옵션에 대하여 공부하기가 쉽지는 않았습니다. (4)

Miso

|

2025.04.16

|

추천 0

|

조회 869

|

Miso | 2025.04.16 | 0 | 869 |

| 851 |

미주 헷징 (3)

호랑이

|

2025.04.04

|

추천 0

|

조회 607

|

호랑이 | 2025.04.04 | 0 | 607 |

| 850 |

미국 주식 콜옵션, 왜 어떤 사람들은 만기 전에 행사할까? (4)

LowKey

|

2025.03.27

|

추천 2

|

조회 716

|

LowKey | 2025.03.27 | 2 | 716 |

| 849 |

미국 경제지표는 아직 좋다하는데…지금의 하락이 단순한 조정인건지..아님 리세션 초입인건지..너무 힘드네요.. (2)

ans

|

2025.03.23

|

추천 1

|

조회 492

|

ans | 2025.03.23 | 1 | 492 |

오늘 쿠팡은 그와중에 상승

글게요 쿠팡 엄청 올랐네